Most traders spot a pin bar, enter the trade immediately, and wonder why they get stopped out minutes later. You see a long wick, you think “reversal,” but the market continues its original path. This happens because you are viewing the pin bar as a simple shape rather than a liquidity signature.

Trading without a filter is a recipe for a shrinking account balance. To win, you must distinguish between a “noisy” candle and a genuine institutional rejection. This guide breaks down the professional framework used at sarowarjahan.com to trade pin bars with precision.

The Anatomy of a High-Probability Pin Bar

A pin bar is a single-candle pattern that represents a sharp rejection of price. It tells a story of a battle where one side was crushed by the other.

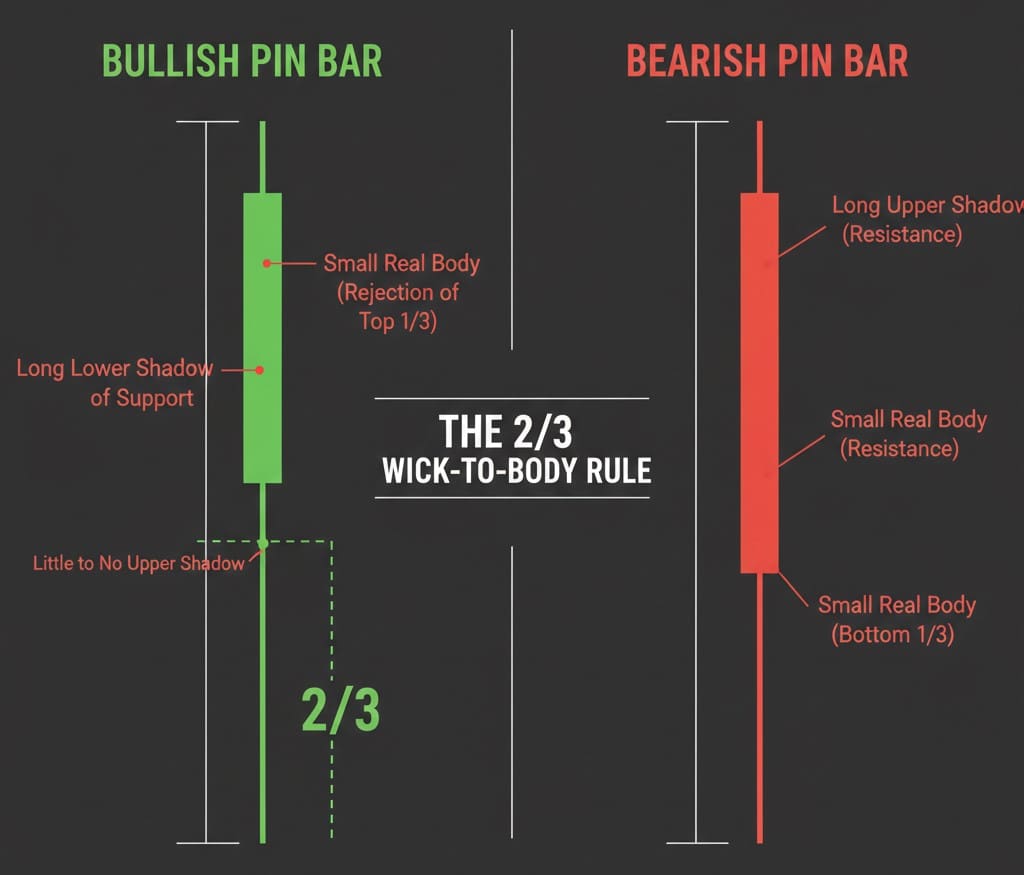

To qualify as a “high-probability” setup, the candle must meet strict criteria:

- The Tail (Wick): Must be at least two-thirds the total length of the candle.

- The Body: Must be very small and located at one end of the wick.

- The Nose: Ideally, there should be little to no wick on the opposite side of the tail.

Why Most Pin Bars Fail (The Liquidity Trap)

Retail traders often treat every rejection candle as a signal. Institutional players know this. They often “push” price into a zone to trigger retail stop losses, creating the institutional liquidity they need to fill their large orders.

If a pin bar forms in the middle of a range (no-man’s land), it is likely market noise. A valid reversal requires market sentiment to hit a breaking point. Without a clear “reason” for the rejection, the candle is just a trap.

The 3-Point Rejection Filter: A Professional Framework

Before you click “buy” or “sell,” run the setup through this checklist:

- Location: Is the pin bar rejecting a major support or resistance level?

- Trend Confluence: Is the rejection occurring in the direction of the dominant high-timeframe trend?

- Space: Is there “clean traffic” to the left, or is the price heading straight into another obstacle?

Valid Signal vs. False Signal

| Feature | High-Probability Pin Bar | Low-Probability (Avoid) |

| Location | Key S/R or 20 EMA | Middle of a consolidation |

| Wick Length | 2x or 3x the body size | Small wick, large body |

| Timeframe | H4, Daily, Weekly | 1-minute or 5-minute |

3 Pro Entry Strategies for Pin Bars

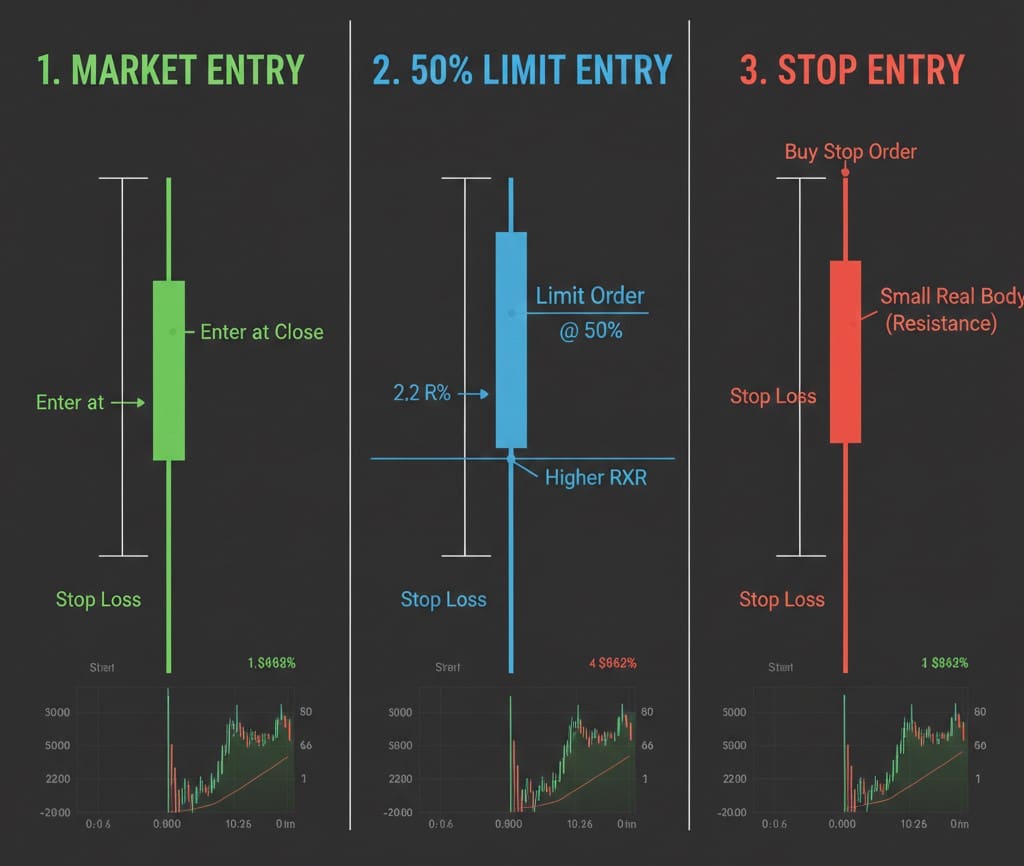

How you enter determines your risk-to-reward ratio. There are three primary ways to play the setup:

- Market Entry: You enter as soon as the candle closes. This ensures you don’t miss the move but offers a wider stop loss.

- On-Stop Entry: You place a “buy stop” or “sell stop” just past the nose of the candle. This confirms momentum is moving in your favor.

- 50% Retrace Entry: You place a limit order at the halfway point of the wick. This is the preferred method for professional traders at sarowarjahan.com because it allows for a much tighter stop loss.

Live Case Study: Trading Pin Bars on XAUUSD (Gold)

Gold is highly volatile and loves to “hunt” liquidity. In a recent setup on the Daily chart, price surged toward a multi-month resistance level.

Instead of breaking through, it left a massive upper wick a Bearish Pin Bar. By using the 50% entry technique, a trader could have entered with a 40-pip stop and targeted the next support level for a 1:4 reward. This is how you use price action to turn volatility into profit.

FAQ: Mastering the Pin Bar

What is a Pin Bar strategy in Forex?

A Pin Bar strategy identifies market reversals by spotting a single candlestick with a long wick and small body, signaling a sharp rejection of a specific price level. It shows that the current trend has run out of steam and a new move is starting.

How do you identify a valid Bullish Pin Bar?

A valid Bullish Pin Bar features a long lower tail (at least 2/3 of the candle length) and a small body at the top, ideally rejecting a support zone. The long wick proves that bears tried to push price down but were aggressively rejected by bulls.

Where should you place a stop loss in a Pin Bar trade?

Place your stop loss 2-5 pips outside the tip of the pin bar’s wick to protect your capital if the rejection level is breached. This ensures that if the market “re-tests” and breaks the wick, your trade thesis is invalidated.

Is the Pin Bar strategy effective on all timeframes?

While pin bars appear on all charts, they are most reliable on higher timeframes like the H4, Daily, or Weekly charts where there is less market noise. Lower timeframes often produce “fake” signals due to minor news events or temporary liquidity spikes.

What is the 50% Pin Bar entry technique?

The 50% entry technique involves placing a limit order at the midpoint of the pin bar’s wick to achieve a superior risk-to-reward ratio. While you may occasionally miss a trade that doesn’t retrace, the trades you do catch will have significantly higher profit potential.

Connect on Telegram Don’t miss out on critical market updates. Join my Telegram community for the latest news and trading signals delivered straight to your phone: https://t.me/mql5signals_Sarowar